Case Study

Escrow Trakker - For Lawyers

Hybrid/Cross-platform

Escrow Trakker

Escrow is a financial agreement in which the funds, documents or items of value are held by a third party on behalf of, and for the benefit of, two parties involved in a transaction. The third party will hold the funds for the duration of the conditions agreed upon by the parties involved.

In legal terms, lawyers also regularly hold funds for clients in a trust account or escrow account (settlements, for example). These accounts must be tracked in great detail, recorded properly, and handled according to detailed rules of legal ethics and law. In this regard, Escrow Trakker can be a great assistant.

Escrow Trakker is a specialised escrow management software designed for legal professionals, helping law firms easily track, manage, and reconcile escrow accounts and client trust funds in compliance with legal accounting standards.

It’s built to reduce errors, automate account management, and keep lawyers audit-ready by maintaining clear, detailed transaction records. The tool works as a cloud-based solution with optional mobile access, giving legal teams flexibility to manage escrow accounts on the go.

Tech Stack

Challenges & Problems

Escrow and client trust accounting software management is a crucial and significant duty for law firms, with stringent compliance requirements and financial accuracy standards.

Even so, a lot of law companies continue to handle their accounting using laborious handwritten bookkeeping, trust accounting software that isn’t made for the specialised escrow management required by the legal profession, or spreadsheets that do the same function as pen and paper.

In the end, this results in delayed, ineffective procedures, accounting mistakes, and a higher chance of noncompliance during audits.

Complex Escrow Tracking

Tracking individual transactions, accurately managing several client trust accounts, and maintaining real-time financial transparency are all made more difficult by traditional technologies.

Audit Readiness Issues

Creating accurate and compliant reports manually can be tedious, full of mistakes, and in violation of bar association rules.

Lack of Legal-Specific Features

Generic and basic trust accounting software for lawyers does not provide any escrow-specific characteristics like compliant reports, fund segregation, and approvals for transactions.

Limited Mobile & Cloud Access

Managing escrow transactions and trust accounts in the field can be complicated without an appropriate, cloud-based, securely managed accounting solution for legal professionals.

Risk of Human Error

Manual reconciliations and tracking of transactions can leave you open to the risk of financial discrepancies, penalties, or trust account breaches.

Solutions Implemented

Escrow Trakker addresses these legal accounting challenges by offering a dedicated, cloud-based escrow management platform tailored specifically for law firms:

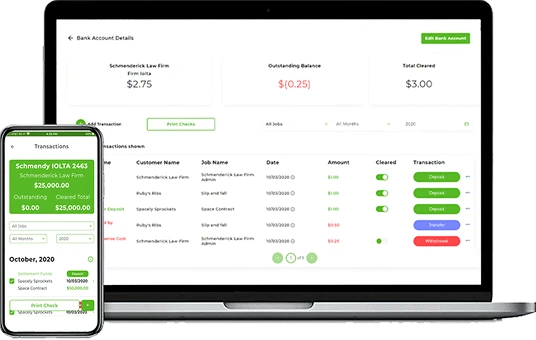

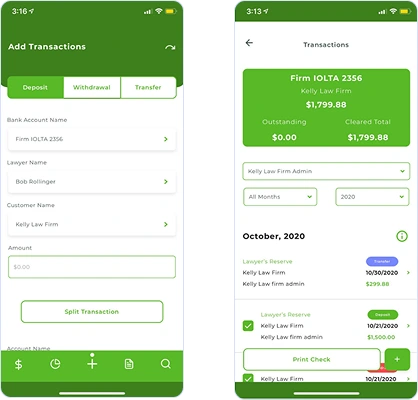

Automated Escrow Tracking

Attorneys may easily record, monitor, and handle numerous escrow and client trust transactions in real-time. The technology eliminates the need for human spreadsheets and paperwork by automating money segregation, transaction reporting, and account activity monitoring.

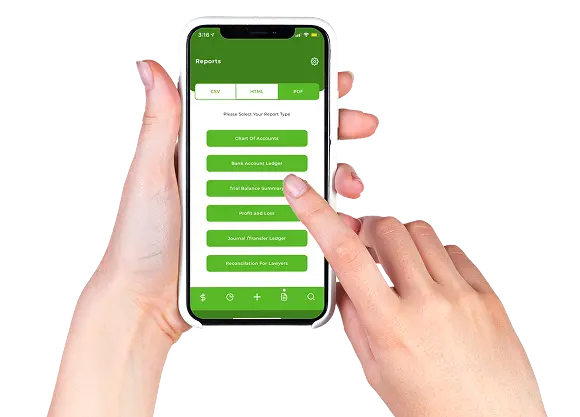

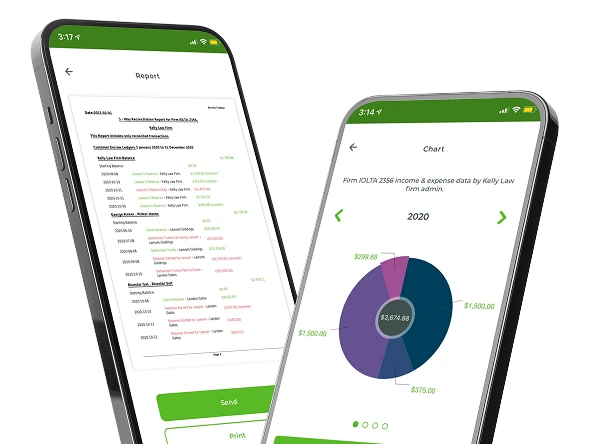

Audit-Ready Reporting

Thanks to integrated compliance-ready reporting systems, law firms can quickly produce transparent, accurate financial reports in compliance with state bar and legal accounting regulations. This will make audits easier and keep businesses 100% transparent and resistant to penalties.

Secure Account Reconciliation

The software has a simple account reconciliation function that allows customers to quickly and properly match bank statements to escrow records. This minimises the possibility of human error and financial disparities.

Legal-Specific Financial Management

Unlike generic accounting tools, Escrow Trakker includes legal-specific features like trust fund segregation, transaction approvals, and escrow activity logs designed to meet the law industry’s needs.

Cloud-Based & Mobile-Ready Access

Being cloud-based, accounting for lawyers can safely manage escrow records from anywhere, with mobile access being possible to review, manage, and administer accounts seamlessly on the go.

Enhanced Accuracy & Efficiency

Replacement escrow management systems point by point: Minimises manual work, reduces errors, increases compliance, and frees up valuable lawyer hours for case management and client service!

UI/UX Design

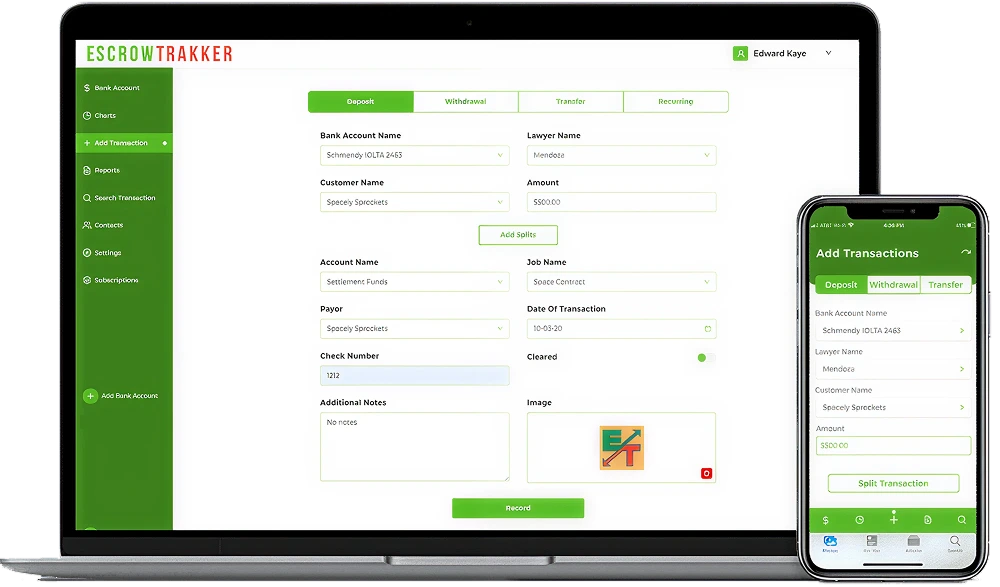

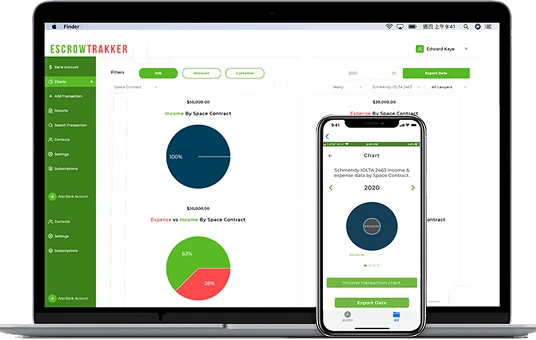

Professional and Intuitive Interface

The design looks clean and professional enough for an accounts and legal professional and lets everyone easily get important escrow information with limited distractions. Labels are explicit, tables are uncomplicated, categories are logical, and the users can easily move across their different client accounts.

Dashboard-Driven Navigation

The dashboard is a centralised, easy-to-read view of active escrow accounts and pending transactions while showing reconciliation. Active accounts issue quick action buttons and display organised menus that allow the user to complete material tasks, like adding a new transaction, generating reports and reconciling accounts within a few clicks.

Legal-Focused Visual Elements

Custom icons, colour-coded transaction statuses, and organised fund summaries offer lawyers at-a-glance clarity on account health and activity. To prioritise critical actions, reconciliation alerts and compliance warnings are graphically emphasised.

Responsive and Cloud-Optimised Design

The platform is completely responsive and available in both web and mobile formats. The platform continues to ensure a consistent user experience for lawyers who are working in the office, on a case in court or while working remotely. All screens of a user’s device are responsive and create a user-centric experience.

User-Centric Financial Tools

Even non-technical users can create and understand financial records with ease because to the usability-focused design of interactive reporting tools, transparent financial charts, and export-ready statements.

Impact

Increased Operational Efficiency

Law firms were able to manage transactions more quickly and with less administrative load by automating escrow tracking and reconciliation. This freed up legal teams to focus more time on servicing their clients.

Improved Financial Accuracy

The platform reduced human error involved in the management of escrows, which in turn reduced errors and the risk of expensive compliance issues by ensuring accurate records.

Higher User Adoption and Satisfaction

The clean and intuitive design, along with other legal features, led to high levels of user acceptance within law firms. This was evidenced by increased rates of daily use and newly found satisfaction in the management of their financials.

Boosted Data Security and Compliance

The cloud, a secure infrastructure built for accounts and legal practices, allowed firms to keep sensitive financial data safe while satisfying legal and ethical obligations related to escrow management.

Enhanced Audit Readiness

Firms also received financial reports instantly for audits, which improved the audit process and trust account oversight.

Conclusion

Escrow Trakker, an accounting for lawyers, completely revamped the way law firms were managing their escrow and client trust accounts by providing a secure, sophisticated, compliance-oriented financial management solution.

It’s automation that tracks usage, real-time reconciliation, and legal reporting format, all removing headaches that legal professionals contend with while maintaining data accuracy and audit readiness.

Escrow Trakker can be given these advantages because of its cloud-based platform that has an intuitive interface and strong financial management tools, which have made it a practical option for law firms and lawyers looking for efficiency, compliance, and peace of mind in managing escrow accounts.

It speaks to how interesting legal tech can make complicated financial tasks easier and improve productivity across the firm.

FAQ's

Who can benefit from using Escrow Trakker?

Law firms, solo legal practitioners, and legal accounting teams that manage client trust or escrow accounts can benefit from using Escrow Trakker. It’s especially useful for firms dealing with frequent settlements, real estate transactions, or client fund management where legal compliance and financial accuracy are essential.

Do I need accounting knowledge to use Escrow Trakker?

Escrow Trakker is built with a user-friendly, lawyer-centric design that makes it easy for non-accounting professionals to manage, track, and reconcile escrow accounts. The interface is clear and intuitive, with helpful guides and automated tools to simplify financial tasks for legal professionals.

What’s the process to switch from my current system to Escrow Trakker?

Switching to Escrow Trakker is simple and seamless. The support team will help you migrate your existing escrow and trust account records into the system securely. After setup, you’ll receive personalised onboarding assistance and training to get your team up and running without disrupting your daily operations.

How do I reconcile my monthly bank statements with Escrow Trakker?

Escrow Trakker offers an automated account reconciliation tool that lets you quickly match your bank statement entries with escrow transaction records in the system. Discrepancies are flagged automatically, and you can generate audit-ready reports instantly.

How can I get in touch with Escrow Trakker's customer support team?

You can reach out to Escrow Trakker’s support team via email, phone, or live chat directly through the platform. They offer responsive, expert assistance for technical issues, onboarding, and day-to-day queries to keep your practice running smoothly.